Why is it that we still run a national debt with interest payments when we are the monopoly issuer of our own currency and effectively borrowing back what we alone can create? The short answer is we do no such thing, the UK sells bonds so swaps one asset for another, we will issue bonds to any holder of GBP. No other currency is ever accepted for treasuries (bonds) sometimes known as gilts. The difference between the two is the schedule of interest payments. So if the government receives money it means it has more right? No. That money is paid back with interest known as the coupon and therefore appears as the national debt. Many argue that debt interest payments are nothing more than corporate welfare as the bonds are essentially risk free, the UK government can never run out of pounds to pay debt and interest. So why is the system still in place?

In days gone by we had the Gold Standard, all notes in circulation could be swapped back into gold, this is why to this day every note in your pocket has the words “I promise to pay the bearer” printed on it, all fiat money is based on a faith in that promise. This is from Investopedia “From 1871 to 1914, the gold standard was at its pinnacle. During this period near-ideal political conditions existed in the world. Governments worked very well together to make the system work, but this all changed forever with the outbreak of the Great War in 1914″. The system proved hopeless during more turbulent times and huge imbalances occurred, for example, at the end of WWII America held 75% of all the gold in the world, but this rapidly drained to pay for surging imports and rebuilding after the war. It’s purpose of restraining state spending failed.

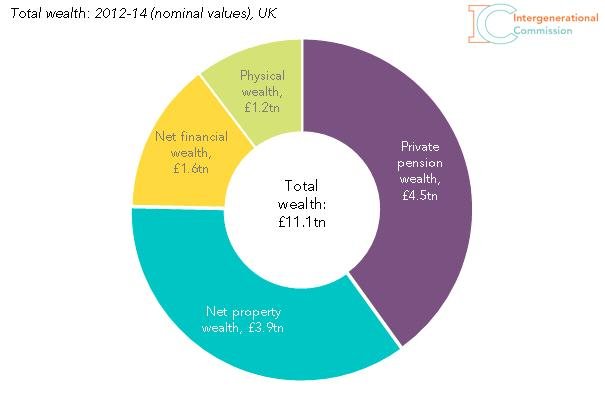

The first ever bond issued by the Bank of England in 1693 was to raise money to fund a war against France, a worthy cause I’m sure we’ll all agree. (Note to self: Edit that last bit!) It was thought that rather than printing money to infinity, as is possible with fiat, borrowing money would instill discipline as it had to be paid back with interest. As the Gold Standard prevailed gold production was rarely in step with the economy’s need, so bonds were used to finance shortfalls. Today pension funds especially rely on bonds as a safe way to hold assets on our behalf as bonds are considered safe. To emphasise how important this is Look at this chart. The national debt is other people’s savings or money that hasn’t been taxed yet.

Introducing the Bond Monster, that mythical beast that will overthrow governments unless they deliver austerity on demand, which basically means more for them and less for us. The MMT economist Bill Mitchell has a scathing view of the bond monster and reasons thus.

- The private bond markets have no power to stop a currency-issuing government spending.

- The private bond markets have no power to stop a currency-issuing government running deficits.

- The private bond markets have no power to set interest rates (yields) if the central bank chooses otherwise.

- AAA credit ratings are meaningless for a sovereign government – they can never run out of money and can set whatever terms they want if they choose to issue bonds.

- Sovereign governments always rule over bond markets – full stop.

He has a complete library of blog posts on central banking here.

In a way this is actually is an argument for bonds as they can be used as tool to hit a target interest rate as they currently do through QE, but QE is for another blog. It doesn’t have to be this way but it just is.

We now turn once again to Positive Money and the very knowledgable Ralph Musgrave with whom I have often crossed swords. He too is very firm on the subject of a sovereign government borrowing, “it’s pointless”. In this very detailed paper, (21 page pdf) he says “Abba Lerner is widely credited with being one the first to claim that government borrowing is pointless in that funding government expenditure is not the main purpose of government borrowing”.

We are all familiar with the phrase tax and spend but this is very misleading, a government needs neither taxes or borrowing to spend, it simply shakes the Magic Money Tree, otherwise known as the public purse. The state can create money at will so it spends first then balances the borrowing and taxes after, these are political decisions and little to do with economics. We all know that if a government just keeps on spending inflation will occur so the state reduces this risk via taxation and “borrowing” money. The aim of both these devices is to destroy the amount of money in circulation. Tax taken is money you can’t spend and by offering high interest rates to bondholders that money is not invested elsewhere, this is intentional crowding out of the private sector by the state.

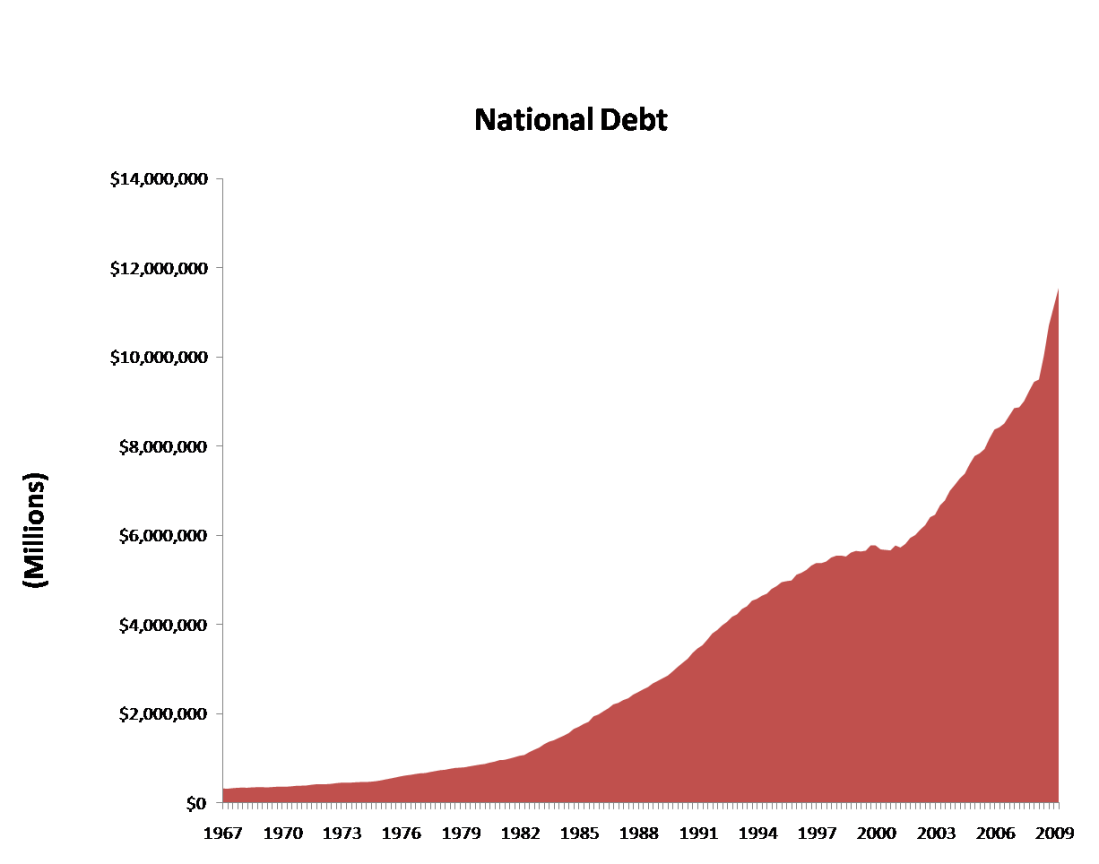

The retention of bond issuance is therefore a matter of politics, especially so since 1971, the abandonment of the Gold Standard by the USA and the rise of Neo-Liberalism. The story runs that the government that the government must be restrained from buying votes with excessive spending by the rigour imposed by the private sector. What has actually happened is that the private banks now issue 97% of all money as debt and get to say where it is spent giving first mover advantage. How has this worked out for national debt levels? Not well.

So much for the private banks and Conservative’s reputation for fiscal prudence, it’s a myth and has been since 1979 and Neo-Liberal order took over, credit where it’s due, they talk a good game. I will hand over to Bruce Hornby and the Range to explain why we still issue bonds paying around £40 billion a year for the privilege.

That’s just the way it is

Some things will never change

That’s just the way it is

That’s just the way it is, it is, it is, it is

This post is dedicated to @woolclip on that there Twitter.

Don’t forget plenty more on my Newsfeed give it a click!

With 97% of all money in circulation being created by the (privately owned) Banks I have wondered whether this recent idea to make us all a cashless society together with those parts of the TPPA and the Investment Treaty, (whose name I can never remember), that enable companies to sue Governments if they pass any legislation that affects their bottom line, is the ultimate goal of Companies being able to control the world.

LikeLike

Hi patricia, and welcome. I have no idea if it’s a conspiracy or the accidental outcome of vested interests act together in self interest. You can now comment freely all first time posters are moderated. thanks for reading.

LikeLike

Thanks for your reply. Where money is concerned I don’t think there is ever an ‘accidental outcome”.

LikeLike

I have no doubt banks collude but everyone else acts in self interest, those with identical aims tend to behave the same way.

LikeLike

Thanks for that Bill, needs repeating especially for myself & back to old Adam Curtis stuff again. Messrs Callaghan & Healey started the rot & as Curtis says it was the start of the period when governments effectively gave away control of the economy to the barrow boys. Interesting comment at the very end of this episode from I think a banker, on Thatcher’s flirtation with Freidman which she denied on TV after it failed, to the effect of his suspicion that they knew it would fail economically, but for them it was worth it as it destroyed the power of the unions.

I sometimes get the feeling that we have a similar situation today, especially in the EU periphery – Shock Therapy discipline for a race to the bottom. Hopefully Corbyn & Co are well aware of the above & once elected they would have the balls to tell the financial harpies to GFT.

LikeLiked by 1 person

Shite…wrong link, although the Okri poem also pretty much sums things up.

LikeLike

One last try….I apologise if it yet again fails : https://www.youtube.com/watch?v=mBZCdNsXbQg&index=2&list=LLHavDAeDMMItTuPCAqIIPUA

LikeLike

Eh oop I think you’ve cracked it there Stevie!

LikeLiked by 1 person

The British government is “printing” money to fund itself.

If you understand the double-entry book keeping system, you’ll know that each side has to be balanced. This led people to form contracts based on this idea: a credit-debt contract. The credit in the world of “printed money” goes to the government, the debt side to a privately owned Central Bank. If you have a bankers’ licence – which most people seem to have these days, you can form derivative contracts and spin the stock markets with the profits.

This hasn’t been spoken of in the mainstream media because it might scare the sheep. Shaking magic money trees is a much nicer – read safer – idea. No responsibility for what the government is doing.

And of course, it’s worked this far, why shouldn’t it work again???

The real problem is as subtle as it is dangerous: the media isn’t speaking of Britain’s debt problem. Poor old John Ward – from whose blog I was unceremoniously banned – knows all about this, but prefers to write idiotic articles about silly politicians. Even Ambrose Evans-Pritchard uses the 2014 figures when discussing Britain’s debt problem.

It’s not the size that counts any more, though. If it were, the problem could be solved using the same thinking that caused it. And we all know what Einstein said about that, yet he still tried solving problems with the same thinking… thank goodness. The real problem here is that some tiny detail – the kind of ‘shock’ you speak of in your inflation post – will bring the markets to the realization that the government and the media haven’t been telling the truth.

That’s when Britain hits the fan and the bits are splattered across Europe and Scandinavia.

As a parting thought, this from John le Carré’s “A Small Town In Germany,” printed in 1969.

Don’t you think it’s interesting that four decades later, HMG sees parting with Brussels as the magic cure for all the British ills? But then, that’s why Britain prints money and Germany taxes its corporations.

LikeLike

Germany is an outlier in economic terms a mirror image of Greece. Britain’s speciality is externalising all it’s problems onto whoever is the “other” flavour de jour. It’s what we’ve always done best.

LikeLike

The externalizing of problems is what one might call a modern psychiatric illness. It doesn’t help Britain to “externalize” and it doesn’t help the country that Britain has pointed a finger at.

It was externalization that led the British government to point the finger at Germany as the villain in the generation running up to the first world war. They did so because the British thought it would solve their economic problems…

The real problem is that the system the British (and Americans) established to show that their economies were the best on the planet… was actually best suited to the Germans! Not that the Brits realized this, or the Germans cared.

Now you say that Greece is the opposite of Germany – that implies that Greece’s structural weaknesses are shared by Britain. Which isn’t far from the truth of the matter.

LikeLike

That is exactly what I think although we use two different types of currency, UK should have been fine as a money issuer.

LikeLike

Britain is fine as a money issuer. What wasn’t fine was the government not knowing how to deal with the problems it had created. God only knows what Britain’s debt is these days, the 2015 figure was TWICE the 2014 figure, and that is a dangerous precedent. The debt is about to spiral.

Thank goodness nobody in the media is breathing a word about how debt works… because the British government certainly doesn’t.

If it had, it’d have nipped it in the bud. It’s been so long now that it’s about to set seed…

LikeLike

I have been following your comments with interest but could you please explain why, if Britain is a money issuer, does it have a problem with its debt – assuming that debt is in British pounds?

LikeLike

The UK has no problem with debt, it’s our stock of money. Debt was only a problem when our currency was backed by gold and a contrived one at that.

LikeLike

Patricia Smith,

“if Britain is a money issuer, does it have a problem with its debt”

The problem that few economists – leave alone bloggers – realize is that interest has to be paid on the debts the government incurs.

The debt itself can be left to fester and the government can borrow more as it pleases. The problem is with paying the interest to the central bank – in this case, the Bank of England (which is privately owned, if you can get through the bramble patch of legalese in their documents).

With the stuttering economic figures, and the shock of Britain leaving the EU, it’s entirely possible that interest rates will have to be raised.

This won’t be a problem for a government addicted to borrowing – but it could cause a major collapse of the UK economy, where ordinary people borrow money just to get by at the end of the month and rack up credit card debts to buy a new telly. Should this happen – and it is a matter of time, not chance now – then the government’s profligate handling of its debt will be laid bare for all to see.

That is when Britain has a problem with its debt.

LikeLike

Gemma, are you an American? The Reserve Bank here in New Zealand is certainly not privately owned nor is the Bank of England nor the Reserve Bank of Australia. So your argument that the Governments incur interest on debts in their own currency does not stack up when they have a fiat currency and are a sovereign country. The Governments might be silly enough to do so but they certainly don’t have to do so. It’s just an accounting trick.

LikeLiked by 1 person

Would you be happy with a government that relies on an accounting trick???

Shakes head in disbelief.

LikeLike

Yes why not? Everybody else is and that’s all fiat money is, a trick of accounting. The secret is to use money to aquire assets and wealth.

LikeLike

The debt that Britain is stacking up won’t be so easy to trick, once it gets totally out of control.

As to wealth, there are still ways to buy silver at €3 an ounce 😉

The real stuff. Not the paper, like the derivative gold that is only an accounting trick… a trick so carefully played out that even the salesmen think it’s real gold they’re selling – and they’ll levy a charge for storing your “gold” in a secure environment.

Did you know that a US bank can ‘hire out’ its gold reserves and still count them as part of their inventory?

LikeLike

While I have an interest in how the financial system works I am not an economist nor an accountant but I take comfort from that because most economists and accountants do not understand it either. Have you noticed that when they are challenged their voices, or writings get louder and louder? Always a lack of understanding I have found. Anyway I do not think a sovereign government debt in its own currency is a problem. As it is a fiat currency it can be wiped as easily as it was created. From what I have read most of my country’s (New Zealand) foreign debt is in our own currency. It is when a country borrows in another’s currency you can have a problem That Country then becomes no different from an individual debtor. From what I have read America is in a different position because a) its Federal Reserve is privately owned and b) its $ is the world’s reserve currency, although currently there is an attempt to change that. I do not understand the American system. I have not read much about it. Perhaps I should! The real real problem is, in my view, private debt. A capitalist society is run on the circulation of money within it. If a balance is not kept between those who have and those who haven’t the system collapses. Post war it worked well for around 25 years but then those who have decided they wanted more at the expense of those who have not. The poor were encouraged to borrow to maintain their lifestyles rather than get higher wages. I remember those first advertisements here in the 1980s encouraging people to increase their mortgage in order to have a holiday or buy a car. We were aghast! It hasn’t stopped. But if you think that through, all the interest that is being paid to the Private Banks is not being circulated and one day the people will not be able to borrow anymore because all their wages are being paid to those private banks as interest. While you might say there is always another generation coming on that can be millked. Yes, there is, but they are in debt with student loans from the moment they leave school. So in my view it is the private debt that is the elephant in the room. But there is always a solution and it does not need to be War.

LikeLike

Try again, WordPress is playing up.

Patricia Smith,

“if Britain is a money issuer, does it have a problem with its debt”

The problem that few economists – leave alone bloggers – realize is that interest has to be paid on the debts the government incurs.

The debt itself can be left to fester and the government can borrow more as it pleases. The problem is with paying the interest to the central bank – in this case, the Bank of England (which is privately owned, if you can get through the bramble patch of legalese in their documents).

With the stuttering economic figures, and the shock of Britain leaving the EU, it’s entirely possible that interest rates will have to be raised.

This won’t be a problem for a government addicted to borrowing – but it could cause a major collapse of the UK economy, where ordinary people borrow money just to get by at the end of the month and rack up credit card debts to buy a new telly. Should this happen – and it is a matter of time, not chance now – then the government’s profligate handling of its debt will be laid bare for all to see.

That is when Britain has a problem with its debt.

LikeLike

Gemma, the BoE is not privately owned, all interest on debt accryes to the UK treasury.

LikeLike

“Gemma, the BoE is not privately owned” As mentioned, the question of ownership is buried under a heap of legalese…

… which makes it a lot easier for the government to borrow, doesn’t it?

LikeLike

But for whose benefit does the state borrow? The people just get crumbs,

LikeLike

“interest has to be paid on the debts the government incurs'”. In the western world the ordinary person has to pay interest on the money they borrow and yes, encouraging people to borrow to live instead of increasing wages and benefits will come back to haunt a Country – all countries – but to talk of sovereign Governments incurring interest on their own currency when they are issuers of that money is just confusing the issue.

LikeLike

We have traditionally balanced spending with debt issuance to artificially constrain state spending. It is that simple and that stupid.

LikeLike

“but to talk of sovereign Governments incurring interest on their own currency when they are issuers of that money is just confusing the issue”

It’s obvious that the role of the Central Bank is too confusing for most people to grasp. Which is just as well, because if sterling falls any further, there are going to be some economic fireworks that most people will not be able to comprehend because they think that governments do not incur interest on the debts they’ve piled up.

LikeLike

https://goo.gl/Ldnt3B

This quiz based on the Positive Money one explains many of the Magic Money Tree concepts one encounters when one delves into this question.

LikeLike

This is the shorter PM money quiz which famously most MP´s failed to answer correctly. A huge part of the problem is the ignorance of the Political Class on these questions.

http://www.quiz-maker.com/Q4FBT85

LikeLike